Wise Insurance Agency LLC Blog

|

|

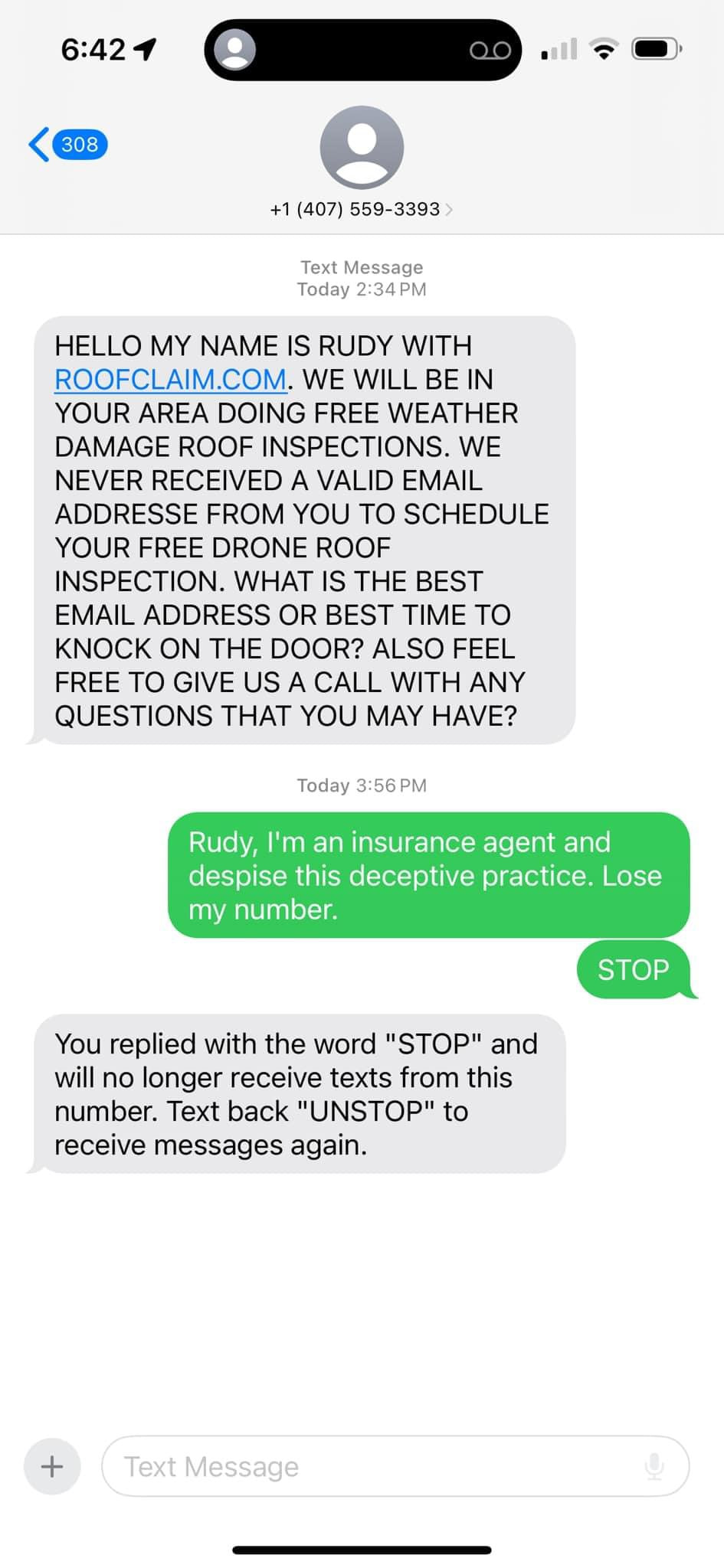

Why Contractors Should Always Review Their Forms and Endorsements with Their Insurance Agent Before Binding a PolicyAs a contractor, your job is to ensure every detail of a project is meticulously planned and executed. But one crucial aspect that often gets overlooked is thoroughly reviewing your insurance forms and endorsements before binding a policy. This oversight can lead to significant financial and legal consequences, leaving you vulnerable and liable out of pocket for damages incurred on the job. Here’s why you should always review these documents with your insurance agent and how Jamie Blair at Wise Insurance can assist you in this essential process. Understanding Forms and EndorsementsInsurance policies for contractors often include various forms and endorsements that outline the specific coverages, exclusions, and conditions of the policy. Forms are standard policy provisions, while endorsements are amendments that modify the standard policy. These can add, remove, or restrict coverage. Failing to review these can result in gaps in your coverage, exposing you to potential liabilities. Why Review is Crucial

Contact Jamie Blair for a Policy Review. Don’t leave your business exposed to unnecessary risks. Contact Jamie Blair at Wise Insurance today for a comprehensive policy review. Ensure your insurance coverage aligns with your specific needs and protects you from unexpected liabilities. Taking the time to review your forms and endorsements with a knowledgeable insurance agent is a small step that can make a significant difference in the long-term security and success of your contracting business. Don’t wait until it’s too late—get in touch with Jamie Blair at Wise Insurance and safeguard your business today. 863-534-3431 or [email protected]

0 Comments

General Liability Insurance: This foundational coverage protects your business against claims for bodily injury, property damage, or personal injury caused by your services, operations, or employees. Property Insurance: This insurance covers your business property—including buildings, equipment, inventory, and furniture—against damage or loss due to fire, theft, vandalism, or other covered perils. Commercial Auto Insurance: If your business uses vehicles for operations, commercial auto insurance provides coverage for accidents, liability, and vehicle damage involving company-owned vehicles. Workers' Compensation Insurance: Required in most states, workers' comp covers medical expenses and lost wages for employees injured on the job. It also protects your business from potential lawsuits related to workplace injuries. Professional Liability Insurance (Errors & Omissions): Also known as E&O insurance, this coverage protects professionals against claims of negligence, errors, or omissions in their services. Cyber Liability Insurance: In today's digital age, cyber insurance is essential to protect your business from cyberattacks, data breaches, and related liabilities. Business Interruption Insurance: This coverage helps replace lost income and covers ongoing expenses if your business is forced to close temporarily due to a covered event (e.g., fire, natural disaster). Why Choose Wise Insurance Expertise and Experience: Wise Insurance specializes in commercial insurance, with years of experience serving businesses in Polk County. Our team understands the unique risks faced by businesses and can tailor coverage to your specific needs. Customized Solutions: We work closely with you to assess your business's risks and recommend tailored insurance solutions that provide comprehensive coverage without unnecessary expenses. Local Knowledge and Personalized Service: As a local agency, we have deep knowledge of the Polk County business landscape. We prioritize personalized service, offering prompt assistance and ongoing support to address your insurance concerns. Save Money and Protect Liabilities: Our goal is to help you save money while ensuring your business is adequately protected. We negotiate with reputable insurance carriers to secure competitive rates without compromising on coverage quality. Trusted Advisor: Wise Insurance isn't just an insurance provider; we're your trusted advisor and partner in risk management. We're committed to building long-term relationships based on trust, transparency, and reliability. Protect Your Business Today Don't wait until disaster strikes. Partner with Wise Insurance to safeguard your business with comprehensive commercial insurance coverage. Whether you're a small startup or a well-established corporation, we're here to help you navigate the complexities of commercial insurance and protect what matters most to you. Contact Wise Insurance in Polk County today at 863-534-3431 to schedule a consultation. Let us be your commercial insurance specialist, dedicated to protecting your liabilities and saving you money. Your business's future deserves the peace of mind that comes with reliable insurance coverage—trust Wise Insurance to deliver. In a world filled with uncertainties, having the right insurance coverage is essential for protecting what matters most to you. Whether it's your home, your vehicle, your business, or your loved ones, insurance provides peace of mind and financial security in the face of unexpected events. However, with so many options available, how do you know which insurance agency to trust with your coverage? At Wise Insurance Agency, we understand that choosing the right insurance partner is a crucial decision. With our commitment to excellence, personalized service, and comprehensive coverage options, we believe we stand out as the premier choice for all your insurance needs. Here's why you should choose Wise Insurance Agency:

Navigating the Process: Becoming a Vendor Contractor with the Polk County Building Department4/9/2024 Embarking on the journey to become a vendor contractor with the Polk County Building Department can be a significant step for professionals in the construction industry. Polk County, known for its bustling construction sector and diverse projects, offers ample opportunities for contractors. However, navigating the process of obtaining jobs with the Polk County Building Department requires diligence, patience, and a thorough understanding of the procedures involved. In this blog post, we will delve into the essential steps and considerations for contractors aspiring to work with the Polk County Building Department.

Understanding the Requirements: Before diving into the application process, it's crucial to familiarize yourself with the requirements set forth by the Polk County Building Department. These requirements typically include:

Maintaining Compliance: Once approved as a vendor contractor, it's essential to maintain compliance with all regulations and requirements set forth by the Polk County Building Department. Stay updated on any changes to building codes or procedures and ensure that your work consistently meets the prescribed standards. Conclusion: Becoming a vendor contractor with the Polk County Building Department offers exciting opportunities for construction professionals to contribute to the region's growth and development. By understanding the requirements, navigating the application process diligently, and fostering positive relationships within the industry, contractors can position themselves for success in securing jobs and delivering high-quality workmanship within Polk County's vibrant construction landscape. |

Contact Us(863) 534-3431 Archives

March 2024

Categories |

RSS Feed

RSS Feed